Gold has faced stiff headwinds lately as investors abandon

alternative investments to chase record-high stock markets. Probably

the most significant has been the major selling hammering the flagship

GLD gold ETF. It has suffered such intense differential selling

pressure that its custodians have been forced to dump enormous

quantities of physical gold. What are the implications of this flood

of new supply?

The amount of gold bullion GLD has hemorrhaged recently is amazing.

To put it into perspective, earlier this week the rumor that embattled

Cyprus may be forced to sell its official gold reserves made news.

The Cypriot government owns 13.9 metric tons of gold. But on a single

trading day alone in February’s gold capitulation, GLD had to sell 20.8

tonnes! The supply recently added by GLD dwarfs everything else.

Why is GLD dumping gold so aggressively? While silly conspiracy

theories abound as always in the gold world, the reality is far less

provocative. GLD’s mission is simply to track the price of gold. The

World Gold Council (which is funded by leading gold miners) created

this gold investment vehicle in November 2004 to offer stock investors

an easy, cheap, and efficient way to obtain gold exposure in their

portfolios.

The gold miners created a direct conduit for the vast pools of

stock-market capital to chase gold. The only way for GLD to fulfill

its mission of tracking gold is for this ETF to shunt excess GLD-share

demand and supply into underlying physical gold bullion itself. This

capital sloshing into and out of gold via GLD has naturally had a

massive impact on global gold prices. And lately gold has suffered a

major GLD exodus.

During times like 2009 when gold grows popular among investors, GLD

shares are bought up far faster than gold itself is rallying. This

excess, or differential, GLD demand would quickly force this ETF to

decouple from the metal to the upside if not equalized into physical

gold. So GLD’s custodians sop it up by issuing new GLD shares to meet

demand. They then use the proceeds to buy more gold bullion.

But when gold is falling out of favor like now, capital flows

reverse. GLD shares are dumped at a quicker pace than gold’s own

selloff. This differential selling pressure creates an excess supply

of GLD shares. This ETF would decouple from gold to the downside if

this wasn’t equalized into the metal. So GLD is forced to buy up this

excess supply. It raises the cash to do this by selling some of its

gold bullion.

And this is what we’ve experienced lately, heavy differential selling

pressure. As the levitating stock markets rise ever higher,

investors have sold gold to buy general stocks. Because of its

incredible liquidity, GLD has been the epicenter of this

anti-alternative-investment rotation. It’s rather illogical when you

think about it, selling gold low to buy stocks high. Investors are

supposed to buy low and sell high!

But sadly greed and fear always overwhelm reason at market

extremes. Foolish investors rush to sell low after long corrections,

just before new uplegs are born. And later they eagerly flood into

markets after long uplegs, buying high just before major corrections.

Selling low and buying high leads to financial ruin, which is why such a

small fraction of investors ever achieve significant success in the

financial markets.

Gold is universally despised right now because it is low, the ideal

time to buy. General stocks are adored if not worshipped because they

are high, the prudent time to sell. Every day on CNBC, a long parade of

analysts effectively proclaim gold is doomed to sink to zero while

stocks will joyously rally forever more. The intense selling pressure

GLD has faced in recent months simply reflects these emotional

extremes.

As a contrarian I’ve grown rich fighting the crowd, being brave when

others are afraid and afraid when others are brave as Warren Buffett

once eloquently put it. That’s the only way to buy low and sell

high. So I’ve watched GLD’s holdings lately with great interest.

Thankfully this flagship gold ETF is very transparent, publishing its

holdings daily. How does GLD’s holdings plunge stack up relative to

precedent?

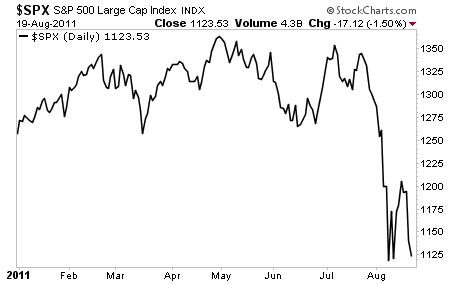

This first chart over the past year or so highlights the extreme

differential selling pressure GLD has faced in recent months. Its

holdings are shown in blue and tied to the right axis, superimposed

over the gold price in red. There has been no bigger headwind facing

gold lately than the deluge of physical-gold-bullion supply GLD has

been forced to dump into the global gold markets. It has proven

overwhelming.

Remember Cyprus’s 13.9t of official gold reserves? The recent

“correction” in GLD’s holdings has forced it to dump a staggering

169.8t of gold bullion simply to keep GLD shares’ price tracking gold!

We are talking about 5.5m ounces of gold here, from this single

American ETF! There are only two gold-mining companies in the entire

world (Barrick and Newmont) that produce that much gold in a whole

year!

Yet the mass exodus from GLD by stock investors forced it to add

169.8t of gold supply in just over 4 months. It’s hard to believe given

how despised gold is today, but back on December 7th GLD’s holdings

hit an all-time record high of 1353.4t. They remained stable and held

near this record for several weeks, until two simultaneous events hit

in early January that started cracking gold’s bullish sentiment.

First the flagship S&P 500 stock index soared 2.5% on January’s

opening trading day on news of the fiscal-cliff tax deal. The biggest

tax hike in US history had been narrowly averted at the very last

minute. And then the very next day, the minutes from the recent FOMC

meeting were misinterpreted to imply the Fed was already preparing to

shut off its brand-new QE3 debt-monetization campaign. So gold sold

off.

Ever since 2013’s fateful initial trading days, those psychological

cracks plaguing gold have spread. Every day that the stock markets’

levitation continued, gold fell farther out of favor among investors.

And then every few weeks there was either an FOMC meeting or the

minutes from one to spook traders into somehow assuming the Fed’s

unprecedented open-ended inflation campaign would end prematurely.

The resulting heavy differential selling pressure on GLD shares is

readily apparent above. This peaked in late February just after gold

selling cascaded into a

full-blown capitulation.

In just 7 trading days late that month, GLD’s custodians were forced

to sell 5.0% of its holdings (65.5t) to buy back enough excess share

supply to keep this ETF from decoupling from gold. Like many market

extremes, this became self-feeding.

As GLD dumped bullion to raise enough cash to buy back the flood of

excess shares being sold, those very gold sales weighed on global gold

prices. This caused more gold stops to be triggered, and kindled more

fear, scaring still more traders into exiting. The lower gold went,

the more people sold, and the more this selling forced GLD to add big

supplies to a very weak gold market. It was a relentless vicious

circle.

As of this past Wednesday, GLD’s holdings had fallen a mind-boggling

12.5% in just over 4 months! It has had to liquidate 1/8th of its

total gold bullion to keep up with stock traders rushing for the gold

exits. Over this same span, the gold price is down 8.6%. Since

rising and falling GLD holdings reveal whether stock traders are buying

or selling gold on balance, I’ve closely followed them daily since

GLD’s birth.

GLD holdings trends are one of the best gold sentiment indicators available. And provocatively they’ve long proven

rather “sticky”.

While stock traders eagerly buy up GLD shares when gold is rallying

and in favor, they have generally not sold too aggressively when gold

was correcting. So the sheer degree of the recent GLD holdings plunge

sure felt exceptional. I’ve been wondering if it was the biggest ever.

So this week I decided to look at all the GLD holdings “corrections”

over this ETF’s entire history. And I was pleasantly surprised to find

out that we’ve weathered worse. Coming off record highs, the recent

169.8t GLD dump is certainly the biggest absolute decline in its

holdings. But in percentage terms, GLD’s holdings suffered even bigger

retreats as gold fell deeply out of favor during 2008’s crazy stock

panic.

My suspicion that the recent GLD holdings plunge was exceptional was

generally correct. Outside of that once-in-a-century stock panic,

GLD’s average holdings correction has merely been 5.9% over 3.9

months. So while the recent holdings correction’s 4.0-month duration

is on par, its 12.5% slide more than doubled what has been typically

witnessed for the vast majority of GLD’s lifespan. It was indeed very

big.

The only comparable declines were leading into and during 2008’s

stock panic, when GLD’s holdings plunged 12.6% over 1.4 months and

later another 13.0% over 2.0 months. It is interesting that these were

the worst GLD selloffs ever seen, and they happened in far-worse gold

conditions.

While gold is merely down 8.6% during the recent GLD

holdings correction, it plunged by 13.3% and 22.0% during 2008’s!

The latter is particularly interesting and relevant today. If there

was ever a time for gold to shine as a safe haven, it was during that

epic stock panic. In a single month in October 2008, the flagship

S&P 500 stock index plummeted 30.0%! Fear was off the charts,

with the definitive VXO fear gauge challenging 90 when only around 50

is normally the worst-case extreme. The financial world was crumbling

right before our eyes.

Yet gold couldn’t catch a bid! Its price plunged 16.7% over that

month-long span where the stock markets lost nearly a third of their

value. Stock investors deployed in GLD rushed to sell their shares,

both disgusted by gold’s failure to surge on a financial Apocalypse and

trying to raise cash wherever they could. Between July and November

2008, gold fell an astounding 27.2%. It was truly a total disaster.

The main reason gold plummeted during that panic is because safe-haven buying flooded

into the US dollar

instead, driving its biggest and fastest rally (22.6% higher in 4

months) ever witnessed. But the key takeaway today is that the

financial world was totally convinced gold was dead. If it couldn’t

rally in that panic, then it was no longer a safe haven. There was no

reason to own gold anymore, its bull was over.

Sound familiar? That’s the exact kind of thing we’ve been hearing

in recent weeks. Because gold hasn’t rallied despite the Cyprus bank

failures and record Fed debt monetizations, there must be something

fundamentally wrong with this metal. Traders are abandoning it in

droves, just like they did in late 2008.

But obviously they were dead

wrong to sell low then when gold was hated. It was on the cusp of

soaring.

Right as investors totally capitulated and gave up on gold in

November 2008, it was carving a major bottom. It would ultimately power

from around $700 then to $1900 by August 2011. And ever since it has

consolidated high, it is simply at the low end of its multi-year

trading range today. A major gold correction driving or being driven

by a massive 1/8th GLD holdings selloff was the best buy signal of

gold’s bull!

I suspect the recent 1/8th GLD holdings correction will prove

similarly bullish. In order for stock traders to dump GLD shares

rapidly enough to force it to sell so much bullion so fast, their

sentiment has to be hyper-bearish. They have to be utterly convinced

gold’s bull is dead to sell so aggressively.

But whenever sentiment

swings to such unsustainable extremes, major bottoms are carved leading

into major uplegs.Extreme GLD selling on a daily basis is also a fantastic contrarian

indicator itself. I generally consider GLD differential selling

pressure on any given day material if it is big enough to force GLD’s

holdings down by more than 0.5% that day alone. And big GLD holdings

liquidation days are over 1.0%. Clusters of these near gold lows are

major bottoming indicators, they reveal sentiment in gold has grown too

bearish to persist.

Since the February gold capitulation, we’ve seen 3 separate trading

days where GLD’s holdings fell more than 1.0%. They are pretty rare

over GLD’s 8.4-year history, only occurring 51 times or about once

every 40 trading days. The last time a similar cluster was seen was

actually in October 2008 during the stock panic, just before gold

started more than doubling in its next mighty upleg that was being born

in despair.

So historically big GLD liquidations, both in individual-trading-day

and multi-month-trend terms, have actually been very bullish

contrarian indicators. This precedent completely contradicts many of

the gold bears dominating the financial media, who claim excessive GLD

selling is bearish rather than bullish. In reality, stock traders

panicking out of GLD shares is an indicator of fear reaching irrational

extremes.

So smart contrarians fight the crowd and aggressively buy GLD

holdings plunges. The only way to buy low is to be brave when others

are afraid, and they are certainly afraid of gold today. Bearishness

in this yellow metal has recently hit extremes not seen since the stock

panic, the best gold buying opportunity of its secular bull. The

recent GLD holdings liquidation was also panic-magnitude, utterly

unsustainable.

Stock investors have been fleeing GLD, selling low, so they can plow

their capital into general stocks near nominal record highs. The

red-hot stock markets have fueled the dismal sentiment in alternative

investments like gold. But as soon as they decisively turn, which

ought to be imminent given how overbought and euphoric the stock markets

are today, the precious metals will start returning to favor.

The same unsustainable hyper-bearish sentiment forcing the massive

GLD liquidation in recent months is crushing the gold miners’ stocks.

They are hyper-oversold, trading at their lowest valuations of their

entire secular bull. The main gold-stock index is scraping

fundamentally-absurd 45-month lows, trading as if gold and silver were

41% and 53% lower than today’s levels! The gold-stock sector is

loathed today.

Which makes it an extraordinary contrarian buying opportunity! At

Zeal we’ve been concentrating our buying around this major gold bottom

in smaller dirt-cheap gold and silver miners with dazzling

fundamentals. As sentiment inevitably turns in gold, the entire

precious-metals realm is going to soar but the best of the miners ought

to skyrocket. We are talking about stock prices tripling or

quadrupling!

So if you have cultivated the mental toughness to buy low when few

others dare, gold stocks are the place to be today. We are constantly

researching that entire universe to uncover the most

fundamentally-promising miners. Last month we published a popular new

31-page fundamental report profiling our dozen favorite junior gold

producers in depth.

Buy it today, buy some great gold stocks cheap, and thank us later!

We also publish acclaimed weekly and monthly subscription

newsletters long loved by speculators and investors worldwide. In them I

draw on our vast experience, wisdom, knowledge, and ongoing research

to explain what is going on in the markets, why, where they are likely

headed, and how to trade them. Our contrarian approach works, the 637

stock trades recommended in our newsletters since 2001 have averaged

stellar annualized realized gains of +33.9%!

Subscribe today!

The bottom line is stock investors have indeed been panicking out of

GLD in recent months. This extreme bearishness has created a

panic-grade drawdown in GLD’s holdings. All this excess gold supply

from GLD’s forced selling has been a major headwind for gold,

exacerbating its latest correction. But historically extreme GLD

selling by stock traders is a major bottoming indicator for the yellow

metal.

Like everything else in the markets, gold bottoms and embarks on

major new uplegs when everyone is convinced it is dead. Widespread

fear soon leads to selling exhaustion, leaving only buyers. So gold

soon starts rallying again, gaining momentum. This coming upleg has the

potential to be very large as the euphoric, overbought, levitating

stock markets inevitably reverse. Alternatives will quickly regain

favor.

Adam Hamilton, CPA

Source

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)