It is ironic that stocks are at five years highs going into what is

probably going to be the biggest disappointment of an earning`s season

since the 2008 financial crisis. We got a hint of 4th quarter results

during the disaster which was the 3rd quarter earning`s season where

most companies missed on the revenue side, and those that beat EPS

guidance, did so barely, and most of that was created through stock

buybacks and creative smoothing techniques.

Make no mistake when a public company sets earning`s guidance these

are numbers that are very conservative, and they expect to blow these

numbers away given a healthy business environment. When a company just

barely hits or beats the EPS number, and misses on revenue you know they

were buying back stock, and trying any possible financial trick to

attain the EPS number. One of the oldest tricks on Wall street, besides

giving easy guidance so that when it comes time for earning`s the stock

shoots up because they “beat” expectations.

The fact that companies have to struggle so much just to meet

expectations tells how bad things are from a corporate profit

standpoint. They have cut their operations to the bone for the last

three years, and built earnings up from the bottom, and that strategy

has reached its point of exhaustion. No more to be squeezed out of that

cost cutting strategy.

The Fiscal Cliff

Moreover, with the continual uncertainty coming out of Washington

from a policy perspective, code word the Fiscal Cliff, it`s unlikely

that CEO`s committed much towards year end discretionary CAP EX

purchases which would spur corporate growth during the fourth quarter.

So expect to hear the term Fiscal Cliff during Earning`s season quite a

lot as the primary excuse for business headwinds by the executive teams

during conference calls.

Deja Vu

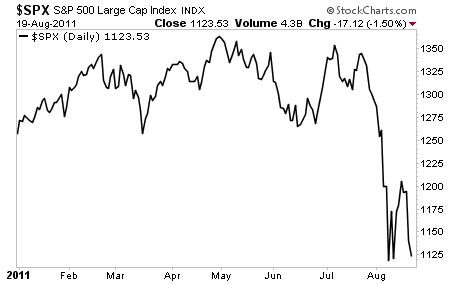

Last quarter stocks were at these same levels, and companies started

missing and no one wanted to sell hoping that they would get better

earning`s reports, but firms just kept missing, and getting taken down

one by one while the market stayed afloat at elevated levels.

Then more and more firms were missing on the same days, the big boys

started missing, and finally the shorts were going to take multiple

firms stocks down on the same day, and Wall Street pumpers threw in the

proverbial towel on an options expiration Friday of all days, and took

prices down to the next level in most stocks.

In other words, they tried to ignore the bad earnings and keep the

rally alive, but the shorts are going to punish bad earning`s regardless

of bullish sentiment.

Expect the same pattern of behavior as most fund managers are sheep

and too stupid to actually get out before earnings season starts, and

buy after the inevitable selloff. They wait and hope and once one big

player unloads they all run for the exits at the same time leaving quite

a carnage in stocks along the way. One benefit is that short sellers

can get some very cheap puts and establish some very attractive entry

points for the inevitable ride back below 1400 in the S&P 500.

The Debt Fight

Moreover, with the upcoming fight over increasing the debt limit just

around the corner expect quite a sizable selloff in markets which sends

everybody back into the comforts of bonds teasing bond vigilantes once

again, and reminding everyone including the fed that we really are still

in a deflationary, deleveraging cycle that will not turn until true

growth based upon sound financial principles are in place in Washington.

Washington is the biggest reason this economy has taken so long to

recover from the financial crisis in 2008. And their ineptitude has

caused the fed to overcompensate with an unprecedented and borderline

extreme monetary solution which remains to be seen what the eventual

unintended consequences are of said policy.

As this is new territory for the fed, and a grand experiment which

economists will be analyzing for the next 50 years of academic study as

to the ultimate costs & benefits to our society.

Cost cutting versus top-line growth

Corporations have had to watch costs the last three years, work their

employees longer hours, control costs from an operational standpoint,

i.e., operate more efficiency and take advantage of low financing and

borrowing costs to manufacture earnings where they can through stock

buybacks and creative use of capital.

But the one thing that hasn`t been present for corporations is an

environment where the economy is robust and we are adding 500,000 jobs a

month to the economy, and they can afford to hire and grow profits from

the top line through new growth opportunities.

Expect to see the 4th quarter earning`s season reflective of

squeezing all that can be had from the bottom line over the last three

years, and the lack of true growth opportunities, which showed its ugly

head during the 3rd quarter earnings results, make a pronounced

appearance this earning`s season.

Fund Managers are slow learners

Stocks will get hit hard as shorts take down the earning`s misses one

by one, until the fund managers get the hint, and start selling before

the shorts eat into their profits, and start dumping everything mid-way

through this earning`s season.

The excuses will be prevalent, all pointing to a lack of certainty

out of Washington, but the real reason is that you can only cut your way

to profits for so long before you need actual real growth in the

economy, and apart from the slight uptick from the bottom in the housing

market, the rest of the economy is just not robust enough to produce

earning`s growth that is reflective of top line opportunities.

By EconMatters

source

here

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)